The costs of non-compliance are substantial, but the benefits of proactive compliance extend far beyond avoiding penalties.

In today’s highly regulated business field, ensuring accurate hourly salary calculations is not just a financial obligation – it’s a critical legal safeguard. Wage and hour lawsuits cost U.S. employers $3.62 billion in settlements in 2021 alone.

Miscalculations or non-compliance with wage and hour laws can expose businesses to severe consequences, including hefty fines, penalties, and costly legal battles. Protecting your business from these risks begins with an understanding of the intricate web of federal and state laws governing hourly wages.

This blog post will delve into the businesses can take to ensure precise hourly salary calculations, mitigating the risk of non-compliance and safeguarding their operations from potential legal pitfalls.

1. Understanding Legal Requirements for Hourly Wages

Accurate hourly salary calculations are crucial for legally protecting your business by ensuring compliance with labor laws and regulations. Utilizing an hourly salary calculator can help maintain transparency and accuracy in wage determinations, preventing potential disputes over employee pay. This tool aids in calculating overtime, deductions, and benefits correctly, thereby safeguarding the business from costly legal issues such as wage theft claims or violations.

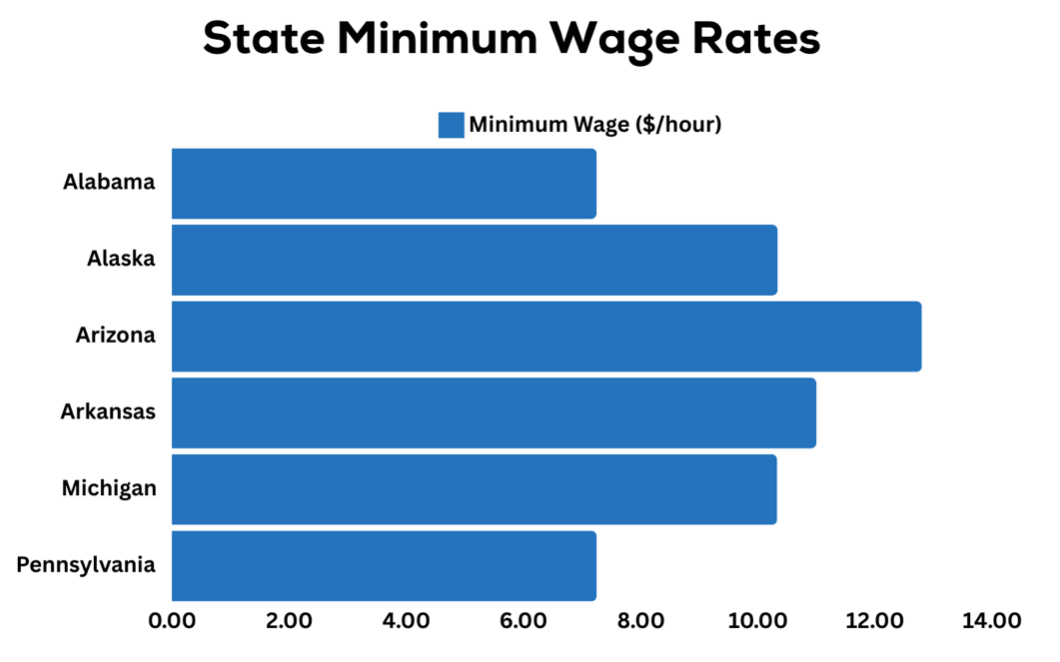

The Fair Labor Standards Act (FLSA) is the cornerstone of federal wage and hour laws, setting the national minimum wage and overtime pay requirements. However, many states have their labor laws that often supersede the federal standards, making compliance a nuanced endeavor for businesses operating across multiple jurisdictions. For example:

- The federal minimum wage state is currently $7.25 per hour in the U.S., but states like California and New York have higher minimum wages at $15.50 and $14.20 per hour, respectively.

- Non-compliance with the FLSA can result in penalties of up to $2,014 per violation, showcasing the high stakes involved in accurate hourly wage calculations.

Failure to adhere to state-specific regulations can result in substantial fines, back pay orders, and even criminal charges in severe cases. Employers must stay vigilant and continually update their policies to reflect the wage and hour.

2. Methods to Ensure Accurate Hourly Calculations

Ensuring accurate hourly wage calculations involves multiple facets, including both technological solutions and processes. Automated timekeeping systems reduce payroll errors compared to manual calculations.

These systems not only streamline the tracking of hours worked but also automate calculations based on the applicable wage and overtime laws, reducing the potential for human error. Additionally, they provide an audit trail, which can be invaluable in the event of legal disputes or investigations.

If discrepancies in wage calculations are identified during an audit or review, businesses should take immediate action to address the issue and mitigate potential legal risks. Steps to consider include:

- Investigate the root cause: Conduct a thorough investigation to understand the source of the discrepancy, whether it was a one-off incident or a systemic issue, and the extent of the impact.

- Correct underpayments promptly: If the discrepancy results in an underpayment of wages, businesses should calculate and issue back pay to affected employees as soon as possible, including any applicable interest or penalties required by law.

- Adjust payroll practices: Based on the findings, update payroll processes, policies, and employee training to prevent similar discrepancies from occurring in the future.

- Communicate transparently: Maintain open and transparent communication with affected employees, explaining the issue, the corrective actions taken, and any necessary changes to payroll practices.

- Seek legal counsel: Consult with experienced labor and employment attorneys to ensure compliance with applicable laws and to develop a proactive strategy for addressing potential claims or legal ramifications.

Taking prompt and decisive action, along with a dedication to transparency and continuous improvement, can help businesses mitigate legal risks, maintain employee trust, and show a genuine commitment to compliance and ethical business practices.

3. The Role of Overtime Calculations in Legal Protection

Accurate overtime calculations are crucial for both hourly wage compliance and legal protection. Overtime pay can account for 20% of total payroll costs for many businesses, making it a significant expense that must be calculated.

Misclassifying employees as exempt from overtime or miscalculating overtime rates can lead to severe legal consequences, including multi-million dollar lawsuits for back pay and penalties. Some high-profile cases have resulted in settlements exceeding $10 million.

To avoid such pitfalls, businesses must have an understanding of the overtime rules and regulations specific to their industry and location. This includes properly identifying non-exempt employees, tracking all hours worked accurately, and calculating overtime rates based on the applicable laws.

Investing in employee training and communication regarding overtime policies can also help mitigate the risk of unintentional violations and foster a culture of compliance within the organization.

4. Preventing Wage Theft and Ensuring Compliance

Wage theft, defined as the denial of rightfully earned wages or employee benefits, is a pervasive issue that costs U.S. workers over $50 billion annually more than all other property crimes combined. For businesses, wage theft allegations can result in costly legal battles, reputational damage, and severe penalties.

To prevent wage theft and ensure compliance, businesses must implement proactive measures that address common pitfalls, such as:

- Misclassification of employees: Incorrectly classifying employees as exempt from overtime rules can lead to underpayment and legal issues.

- Failure to track all hours worked: Not accurately capturing all hours worked, including breaks, travel time, and off-the-clock work, can result in underpayment and wage theft claims.

- Incorrect overtime calculations: Miscalculating overtime rates by failing to account for applicable laws, such as paying time-and-a-half for all overtime hours instead of using the correct weighted average or regular rate calculations.

- Improper deductions: Making unlawful deductions from employee paychecks such as deductions for uniforms or tools without proper consent, can constitute wage theft.

- Failure to comply with state-specific laws: Not accounting for state-specific minimum wage rates, meal and rest break requirements, or other labor laws can lead to violations and penalties.

By addressing these potential sources of wage theft, businesses can significantly reduce their legal risk and foster a culture of transparency and fairness towards their employees.

5. Regular Audits and Their Importance

Regular payroll audits are a critical component of maintaining compliance and mitigating legal risks. These audits involve a review of payroll practices, including hourly wage calculations, overtime payments, employee classifications, and compliance with applicable laws and regulations.

Do you know how often businesses should audit their payroll processes? The frequency of payroll audits should be tailored to the size and complexity of the business, as well as the industry and jurisdictions in which it operates. However, general best practices suggest:

- Large businesses or those operating in multiple states: Conduct payroll audits at least annually, with targeted spot checks and reviews occurring more frequently (e.g., quarterly or bi-annually).

- Small to medium-sized businesses: Perform full payroll audits annually, accompanied by regular internal reviews and checks to ensure ongoing compliance.

- High-risk industries: Businesses in industries with a higher risk of wage and hour violations, such as hospitality, retail, or construction, may require more frequent audits (e.g., bi-annually or quarterly).

It’s important to note that businesses should not rely solely on scheduled audits but should also conduct ad-hoc reviews in response to changes in laws, regulations, or operational changes that may impact payroll processes.

Businesses that conduct regular payroll audits are 50% less likely to face wage and hour lawsuits, as audits can identify and rectify discrepancies before they escalate into legal issues. Additionally, audits provide valuable insights into areas that may require process improvements or additional employee training.

The frequency of payroll audits should be based on the size and complexity of the business, with larger organizations or those operating in multiple jurisdictions requiring more frequent audits. Industry best practices generally recommend conducting full audits at least annually, with targeted reviews and spot checks occurring more regularly.

While audits may seem like an additional expense, the potential cost of a wage and hour lawsuit, which can average $4.5 million, makes them a worthwhile investment in risk mitigation and legal protection.

6. Training and Resources for Payroll Compliance

Ensuring compliance with wage and hour laws is an ongoing effort that requires continuous education and training. As regulations evolve and new legal precedents are set, HR and payroll professionals must stay informed and adapt their practices accordingly.

According to industry surveys, 60% of HR professionals report a need for more training on wage and hour laws, highlighting the knowledge gap that exists in this critical area. Investing in professional payroll compliance training can yield a significant return on investment, with estimates suggesting a 300% ROI by preventing costly lawsuits.

In addition to formal training programs, businesses can use a variety of resources to enhance their compliance efforts, including:

- Organizations like the American Payroll Association and the Society for Human Resource Management provide valuable guidance, updates, and best practices.

- Federal and state labor departments often offer free resources, webinars, and guidance on wage and hour laws.

- Consulting with experienced labor and employment attorneys can provide tailored advice and ensure compliance with the latest legal developments.

By prioritizing ongoing education and using these resources, businesses can stay ahead of the curve and address compliance issues before they escalate into legal challenges.

Conclusion

In the increasingly complex landscape of wage and hour laws, hourly salary calculations are not just a matter of financial ethics, they are a crucial legal safeguard for businesses. By investing in automated systems, employee training, and ongoing education, businesses can foster a culture of transparency and fairness, ensuring that their payroll practices not only meet legal standards but also uphold the ethical treatment of their workforce.

Remember, the costs of non-compliance are substantial, but the benefits of proactive compliance extend far beyond avoiding penalties. It’s about safeguarding your business, your reputation, and your commitment to ethical practices, a winning combination that will pay dividends in the long run.

FAQs

1. Can I pay my salaried employees for overtime?

Generally, salaried employees are exempt from overtime pay. However, if their job duties don’t meet the FLSA’s exemption criteria, they may be eligible for overtime. Consult legal advice to ensure compliance.

2. What if an hourly employee works during breaks or off-duty?

Employers must compensate hourly employees for any work performed, even during breaks or off-duty hours. Failure to do so could lead to wage and hour violations.

3. How do I handle fluctuating workweeks for salaried employees?

If salaried employees’ hours vary weekly, consider the fluctuating workweek method. Divide their fixed salary by the total hours worked each week to determine their hourly rate. Then, pay 0.5 times that rate for overtime hours.

Join the conversation!