Even without flood insurance, rebuilding after Ian and Fiona is likely to expose telling discrepancies between situations in Florida and Puerto Rico.

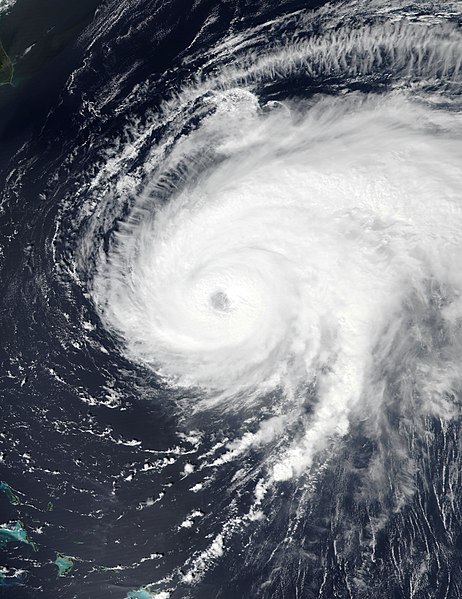

In the last couple weeks, the U.S. has been walloped by a 1-2 sucker punch. Ian and Fiona, two value-sized hurricanes sweeping in off of the Atlantic after forming in response to low pressure areas forming over warm tropical ocean water. Hurricanes are natural phenomena, of course, and have hit the Caribbean and continental mainland for thousands of years. However, the way humans have changed both our social and ecological realities in recent times means that recovering and rebuilding after Ian and Fiona might be harder than many people are prepared for.

We can’t say we weren’t warned. For years, we’ve known that climate change will make storms worse. A physics rule of thumb is that for every degree Celsius (or 1.8°F) the atmosphere is warmed, it can hold 7% more moisture. During Hurricane Ian’s trip through the Gulf of Mexico, it was 0.8°C warmer than normal, so Ian should have dropped 5% more rain. Instead, a study prepared after the storm found that Ian was 10% rainier. That may not sound like much, but when it’s an extra 2 inches on top of 20 inches, the flooding is not going to be any better. Climate change also intensifies hurricanes and makes them move more slowly, lingering and doing more damage than if it had blown by quickly.

Rebuilding after Ian – and Fiona – will be difficult, but for varying reasons.

In Florida, a state that will arguably be among the most affected by climate change, people largely seem to be ignoring that particular elephant in the room. It’s understandable, because admitting there’s a problem means having to do something about it, and “doing something” is hard. Unfortunately, even ignored facts still exist, and will cause unprepared people more pain and expense. With the highest spots in Florida being a mere 320-345 feet above sea level along the central rise, extra-high “king tides” can flood roads and yards while overwhelming storm drains even on sunny days. Sea level rise and Florida’s porous bedrock increase the likelihood of flooding even more. By the time a typical 30-year mortgage is paid off, such events may be common in south Florida even without a hurricane’s exceptional surge.

And yet, surprisingly few Floridians have purchased flood insurance. Within the Florida counties ordered to evacuate, only 47.3% of homes in floodplain areas are covered by flood insurance. Since regular homeowner’s insurance typically doesn’t cover flood damage, rebuilding after Ian without insurance means spending one’s own savings (“personal responsibility”), charity donations, or possibly a small amount from FEMA (which is limited to $40,000, hardly enough to rebuild a home that may be worth ten times that much). However, when separate flood insurance could cost $1,000 per month, it’s easy to understand why families consider it unaffordable. Less understandable is how few potential Florida homebuyers even do their due diligence as far as investigating the chance of their properties flooding.

Flood insurance, like any insurance program, is about spreading risk. Being able to rebuild homes for those who paid a fraction of its cost in insurance premiums depends upon having lots of people buying in whose homes never need replacing at all, a hard sell in economically trying times. (Alternatively, and increasingly, insurers could simply deny more claims to stay afloat.) Government assistance through FEMA eliminates the parasitic cost of shareholder profit from insurance and increases buyers-in while limiting payments, but few will find rebuilding after Ian to be a cakewalk without insurance.

Fiona, despite being a smaller storm, hit Puerto Rico, which still hadn’t recovered completely from Hurricane Maria in 2017. (You may remember the video of then-President Trump tossing rolls of paper towels to Puerto Rican storm victims.) Not only is it hard to repair homes and infrastructure in remote areas on the island, there are also issues surrounding poverty, race, and a lack of representation that make Puerto Rico far less likely to be rebuilt in a timely fashion, especially when compared to some expensive areas in Florida where people have enough money to not care that their home will be unlivable in thirty years. 100,000 Puerto Ricans still don’t have power, and after witnessing the aftermath of Hurricane Maria, they’re dubious that it’ll be restored soon.

Finally, with storms becoming more intense, and with people buying (sometimes quite expensive) homes in marginal and disaster-prone areas, how often will the collective “we” want to keep rebuilding in areas which are, frankly, doomed? Florida’s insurers were already going out of business before the storm. Eventually people will have to abandon some real estate to the waves and move to less scenic but safer places to live, raise their families, and retire (assuming retirement is a thing that continues to exist, a topic for another day).

There’s a big difference between building a luxury home on a barrier island that is little more than a sand spit that shifts at the whim of storms and sea currents, and living in the same island home because generations of history (and poverty) bind you to that land. In the coming months and years, though, it will be interesting to watch the rebuilding after Ian and Fiona, comparing who gets served first, and who has to pitch a tent at the back of the line.

Related: Is Affordable Insurance Sustainable?

Join the conversation!