Tax season can be a stressful time, but armed with the right knowledge and strategies, you can navigate it with confidence.

Tax season – a phrase that sends shivers down the spines of many. The mountain of paperwork, the complex calculations, and the looming deadline can be overwhelming. But fear not! With the right approach, you can navigate this turbulent period with minimal stress and even maximize your refund.

Understanding the Stress

I get it. Tax season is stressful. The uncertainty of how much you owe or how much you’ll get back can be anxiety-inducing. You’re juggling work, family, and life, and the last thing you want to worry about is your finances. But remember, you’re not alone in this. Millions of people go through the same thing every year.

Start Early, Finish Strong

One of the best ways to reduce tax season stress is to start early. Don’t wait until the last minute. Starting early is key to reducing tax season stress. By gathering all necessary documents like W-2s, 1099s, and receipts, and organizing them in a dedicated folder or digital file, you’ll be well-prepared. Understanding potential deductions and credits, such as home office expenses, charitable contributions, or education costs, can significantly impact your refund. Additionally, embracing electronic filing simplifies the process, offering speed, accuracy, and access to helpful tools and tips through various software programs.

Organize Your Finances

Good financial organization year-round, including maintaining detailed records of income, expenses, and deductions, can significantly streamline the tax filing process. Additionally, exploring tax-advantaged accounts like retirement or health savings plans can reduce taxable income and potentially save on taxes. For complex financial situations or uncertainties about tax obligations, consulting with a CPA or tax advisor is recommended for expert guidance and maximizing refunds.

Manage Your Expectations

While it’s tempting to dream about a big refund, it’s important to manage your expectations. Focus on preparing an accurate return rather than hoping for a windfall. And remember, every dollar you save in taxes is money you can put towards your financial goals.

Common Tax Scams and How to Avoid Them

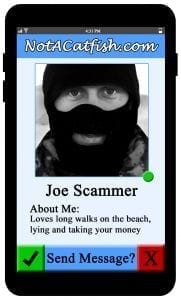

Tax season is unfortunately also a prime time for scammers. Understanding common scams can help you protect yourself and your finances.

Common Tax Scams

Tax season unfortunately attracts various scams, including IRS impersonation scams demanding immediate tax debt payments under threat of arrest, phishing attempts to steal personal information through fraudulent emails or calls, refund identity theft where personal information is stolen to claim fraudulent refunds, and fake tax preparers charging excessive fees, providing inaccurate returns, or stealing taxpayer information.

How to Protect Yourself

To protect yourself from tax scams, remain vigilant against unsolicited contact, as the IRS will never initiate contact via email, text, or social media to request personal or financial information. Always verify the sender of emails by hovering over links to check the actual URL, as legitimate organizations won’t request sensitive information through email. Filing your taxes promptly helps deter others from claiming your refund, and safeguarding your Social Security number, bank account details, and other personal information is important. Additionally, carefully research and verify the credentials of any tax professional you choose to ensure their legitimacy.

Don’t Panic

If you find yourself overwhelmed, take a deep breath. There are resources available to help you through tax season. Consider using tax preparation software, seeking advice from a tax professional, or contacting the IRS for assistance.

Remember, tax season is a temporary challenge. By following these tips and staying organized, you can navigate this period with confidence and peace of mind.

Tax season can be a stressful time, but armed with the right knowledge and strategies, you can navigate it with confidence. By starting early, organizing your finances, and understanding your deductions, you can significantly reduce your tax-related stress. Remember to be vigilant against tax scams and protect your personal information. If you need further assistance or have complex tax situations, don’t hesitate to consult with a qualified tax professional like JC CPAs and Advisors. With proper planning and preparation, you can not only survive tax season but thrive, maximizing your refund and achieving your financial goals.

Join the conversation!