According to recent studies, including one from “TransUnion, a company that helps hospitals collect unpaid bills,” more and more people are failing to pay off their entire hospital bills. In fact, according to TransUnion, “more than two-thirds of patients aren’t paying” off their bills, “and that number could increase to 95 percent by 2020.”

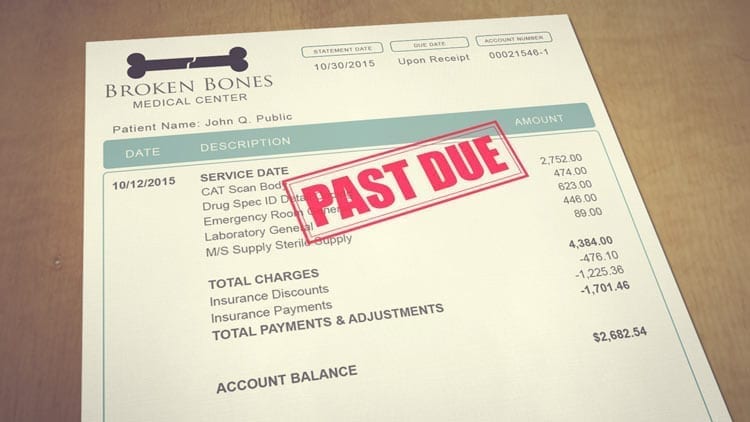

For many across the country, medical bills are fast becoming so high and expensive that many are having trouble making their payments. There are a number of reasons why patients aren’t paying their medical bills. Surprise billing is one, and high deductibles is another. Let’s start with surprise billing. This is “when a patient receives a high, out-of-network bill for care received at an in-network hospital” that is often much higher than they were expecting thanks to nickel and dime fees and a lack of transparency when it comes to the overall bill. The problem with surprise billing is that “patients rarely know what they can expect to pay or what their options are when visiting hospitals and emergency rooms, and no one is held accountable.”

High deductibles are another factor behind people not paying their medical bills. After analyzing patient data, TransUnion, a company that helps hospitals collect unpaid bills, discovered that “higher deductibles and patient responsibility” have grown “from 10 percent to 30 percent over the last few years.” For example, just two years ago “TransUnion found just under half of patients did not pay off hospital bills of $500 or less.”

But wasn’t the Affordable Care Act (ACA) supposed to help patients? Well, it’s true that the ACA has “given more people access to health care, but it has driven deductibles up, in some cases, making it harder for patients to pay,” according to John Yount, TransUnion’s vice president of product for the health-care division. He added, “hospital margins are already between only 2 and 4 percent on average, and that margin quickly narrows when more patients can’t pay their bills.”

So what does that mean for hospitals? Well, Yount said:

“What it means is as a patient takes on more responsibility, then it is likely that that debt, which is a component of uncompensated care, has a potential to increase for hospitals. It’s likely that as they provide services and their bad debt increases, it could be difficult to continue certain operations.”

Already hospitals are being affected by patients not paying their bills. For example, according to the North Carolina Rural Health Research Program, “since 2010, 79 rural hospitals have closed,” and that number is expected to continue climbing if patients continue not paying their bills.

So what can hospitals do, if anything, to get patients to pay their bills? Yount and many others involved in the healthcare industry think that “health-care companies must focus on reducing the cost of services.” While TransUnion found that the majority of outstanding hospital bills are $500 or less, 99 percent of bills more than $3,000 go unpaid on a regular basis.

In a recent statement, Yount said, “we’re starting to see trends of evaluative care and the transition of a payment structure form that’s outcome-based.” He added, “there needs to be a continued effort to help drive costs of health care down.”

Sources:

Two in three patients can’t pay off their hospital bills

2 Out Of 3 Patients Can’t Afford Their Hospital Bills Thanks To Obamacare’s Soaring Deductibles

Join the conversation!