The most compelling results reveal that two seconds is the new threshold in terms of an average online shopper’s expectation for a web page to load.

Shopify is a massive e-commerce platform where more and more people try their business skills hoping to grow their online ventures.

Unfortunately quite a lot of them don’t spend enough time trying to investigate what other, successful e-commerce stores are doing that they also should be doing.

Given that, I decided to compare 100 Top-tier Shopify stores with 50 SME-type Shopify stores.

Some data for the top-tier stores was collected by Louis from Ecommerceranker.com.

I picked the 50 smaller stores using estimated average organic traffic metric (provided by Ahrefs) only choosing websites with anywhere between 500 and 5000 unique monthly visitors.

The idea of this post is to show the difference between best of the best and smaller shops, so that the smaller shops can learn and grow.

As I go I will try to provide as many details as possible while giving actionable remarks.

Let’s do it!

1. Fully Loaded Time (FLT)

Ten years ago, Amazon found that every 100ms of latency cost them 1% in sales.

In other words, if your store is slower than a herd of snails traveling through peanut butter, people will buy less from you. A lot less.

Now, what is “slow” and what is “fast”?

A study conducted by Forrester Consulting (on behalf of Akamai) in 2009 (!!!) shows that:

The most compelling results reveal that two seconds is the new threshold in terms of an average online shopper’s expectation for a web page to load. and 40 percent of shoppers will wait no more than three seconds before abandoning a retail or travel site.

Now that we got the two-second threshold as something our beloved customers can handle, it’s time to actually measure the load speed!

I used GTmetrix to get FLT from my desktop computer (not mobile) and Louis did the same thing.

Here are my calculations from Louis’s database.

Average FLT: 1.262

Median FLT: 1.2

Worst FLT: 3.5

Best FLT: 0.6

Not bad at all!

Now let’s see my sample.

Average FLT: 4.952

Median FLT: 3.95

Worst FLT: 23.3

Best FLT: 1.5

Top-100 Average FLT is almost 4 times (!) shorter than that of my sample.

The absolute worst FLT from my sample is a remarkable outlier.

Take Action: take speed seriously and get your site load under two seconds on desktop and mobile (reach out if you need help with that).

2. Facebook Pixel

FB’s Pixel is an important tool used for retargeting website visitors in order to sell them (as much as possible).

It’s also a handy way to grow the newsletter list which is your money making machine.

But how powerful can a FB Pixel be?

The findings from an experiment by Adespresso shed some light on that:

Simply put, the Pixel allows you to get the same results for $1,000 that you’d get by spending $3,400 on ads when not using the Pixel.

That is a 240% improvement in ad spend which is insane.

Now to our samples!

Unfortunately, Louis didn’t specifically check for FB Pixel being included in the website codes but…he instead has a “Uses Facebook Ads” column which (and I checked that) is a solid proxy for FB Pixel presence.

Out of 100 sites, only seven do not have it installed because:

4 of them are CBD/vape-related (not allowed on FB)

1 of them is about video game t-shirts…and I’m not sure why they aren’t using FB

1 is an adult content site – not allowed on FB

1 is a fonts store and I’m again not sure why they don’t have the Pixel installed

That gives us 93% of stores that have FB pixel installed.

Now…how did my sample perform?

Out of 50 stores, a whopping 19 didn’t have the FB Pixel installed.

2 of them are vape shops which makes total sense

1 of them is adult content

I’m not sure why 16 other stores do not use FB for retargeting purposes

Take Action: if your niche is allowed to advertise on FB, install the Pixel NOW.

3. Domain Rating (DR)

DR is a metric created by Ahrefs (it’s like Moz’s Domain Authority but a little more accurate).

It’s a logarithmic metric, which means that it’s a lot easier to go from 10 to 20 than from 50 to 60.

The higher DR, the easier it is to rank for any of the keywords and the more traffic you get as a result.

Here are my calculations from Louis’s Top 100.

Average DR: 57

Median DR: 59

Lowest DR: 11

Highest DR: 77

And DR metrics from my sample…

Average DR: 30

Median DR: 25

Lowest DR: 4

Highest DR: 45

Take Action: produce worthy content that people will want to link to and build links to your product pages if that’s what Google wants.

4. Dofollow Referring Domains (RDs)

This is essentially what drives DR – the more dofollow domains link to your store or individual product pages, the better they rank…the more revenue you get (and then you can use that FB Pixel too

Here is an example from one of the leaders from Louis’s list – jbhifi.com.au.

Entry #10 and their target keyword for which they rank #1 on Page #1 – bluetooth headphones.

If you look at the number of Referring Domains (RDs) it shows only 9 which is extremely small amount for a competitive keyword of that caliber.

However, give the gargantuan number of dofollow RDs that link to their website as a whole (which is the cause of their massive DR77), they only need a few direct links to the actual product page to rank it so high (and get all that free traffic like I explain here).

Now…talking of the giants from Louis’s list.

Average Dofollow RDs: 3255

Median Dofollow RDs: 2572

Lowest Dofollow RDs: 658

Highest Dofollow RDs: 14421

Now to my list.

Average Dofollow RDs: 113

Median Dofollow RDs: 67

Lowest Dofollow RDs: 4

Highest Dofollow RDs: 614

Average number of Referring RDs for Top 100 performers is 28.8 times higher than that of my sample of Shopify stores.

Take Action: focus on building high quality backlinks that will help to rank your product pages, increase your traffic and revenue.

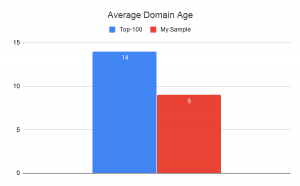

5. Domain Age

I also decided to check domain ages since that is typically considered a factor in SEO and business in general (i.e., the longer you are in business, the more people know about you).

Here the average numbers for the Top 50 domain from Louis’s list (I didn’t take 100 this time).

Average Age: 14

Median Age: 12

Lowest Age: 4

Highest Age: 28

Here are the results from my sample.

Average Age: 9

Median Age: 8

Lowest Age: 1

Highest Age: 23

Take Action: get in the game and stay there – success comes with time!

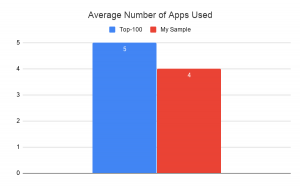

6. App Quantity

Shopify offers a good bunch of apps to ultimately help shops earn more money.

I thought it would be interesting to compare how intense big players are into apps when compared with my SME sample.

So I calculated the number of apps that Top 50 stores from Louis’s sample have and put them against my sample.

First…the Top 50.

Average Number of Apps Used: 5

Median Number of Apps Used: 4

Lowest Number of Apps Used: 0

Highest Number of Apps Used: 15

And here are the results from my sample.

Average Number of Apps Used: 4

Median Number of Apps Used: 3

Lowest Number of Apps Used: 0

Highest Number of Apps Used: 11

You can see that results are almost identical…and that surprised me at the start because apps slow down websites.

So I was expecting to find less apps in the Top 50 because those sites, on average, load almost four times faster!

But here we are seeing that the number of apps has little to do with the load speed in our particular sample (again, apps DO slow down Shopify stores, so get rid of the ones you are not using).

Take Action: get rid of the apps you are not using and, again, work on your stores load speed.

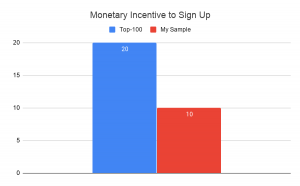

7. List Building Efforts

Fact – money is in the list.

If you have a list of emails you can essentially print money when you want without actually paying for acquiring those sales (like with ads).

Given that, I wanted to see what sort of effort do Shopify stores from Louis’s Top 100 put into growing their subscribers lists when compared to my sample of SME-type Shopify stores.

To do that, I included three metrics:

Homepage popup. This is a popup that would appear the moment you’d enter the site first time (I used Incognito mode to access the stores as if I was visiting them for the first time).

Homepage subscription field. You’d often find that field at the very bottom of the site – right at the footer.

Monetary incentive to sign up. This is an explicit offer that either guarantees a specific discount (most often 10-20%) or a chance to win a product which the given store is selling, in exchange for the person’s email. I didn’t count any vague offers like “sign up and get the latest on sales…”.

Curious to see the difference between the two samples?

Here is what the numbers are for 50 stores from Louis’s Top 100.

Homepage Popup: 19

Homepage Subscription Field: 46

Homepage Popup AND Homepage Subscription Field: 18

Homepage Popup OR Homepage Subscription Field: 47

Monetary Incentive to Sign up: 20

And my sample.

Homepage Popup: 20

Homepage Subscription Field: 40

Homepage Popup AND Homepage Subscription Field: 16

Homepage Popup OR Homepage Subscription Field: 44

Monetary Incentive to Sign up: 10

As you can see almost all the numbers are very similar…all except for the Monetary Incentive to Sign Up.

Monetary incentives in exchange for an email address are used twice as often by stores from Louis’s sample.

I also want to point out the two other findings that grabbed my attention during the research.

Homepage popups from Louis’s sample are a lot prettier from the design point of view.

They also tend to be less intrusive (i.e., might not load immediately on page open but rather 10-15 seconds later).

Take Action: make your popup prettier and less intrusive; offer a small discount in exchange for their email address.

Join the conversation!