The expert knowledge in this long-term disability area continues to evolve, which means that COVID-19 disability insurance claims are rarely “black-and-white”.

In May 2022, the United States reached the morose milestone of 1 million deaths due to the COVID-19 pandemic. In addition to the unfathomable loss of life, there remains another overwhelming struggle for individuals and the workforce – navigating “Long COVID”.

Long COVID symptoms can affect the mind and body severely enough to prevent any employee from performing their essential occupational functions and to meet their disability plan’s definition of “disabled”.

Nearly two-and-a-half years after the first COVID case was reported in the U.S., we are learning more about Long COVID and how it can impact an employee’s ability to return to work, or work at all. Although science and data is moving faster, the insurance industry has seized on debilitated policyholders’ inability to mount much of a fight.

Disability claims are often an uphill battle, and the constantly-evolving science and insurance policy guidelines will impact how an employee can get their long-term disability (LTD) benefits in 2022 for Long COVID. Let’s review how to strengthen your Long COVID LTD claim so that you receive the benefits you or your employer paid rich premiums for.

Common Symptoms

The Centers for Disease Control and Prevention (CDC) recognizes that people who experienced more severe COVID-19 illnesses, those with prior underlying health conditions, and who did not get a vaccine are among the most at-risk for Long COVID.

COVID-19 long-haulers typically start with milder infections and later suffer symptoms that are not as obviously debilitating. The symptoms range and include:

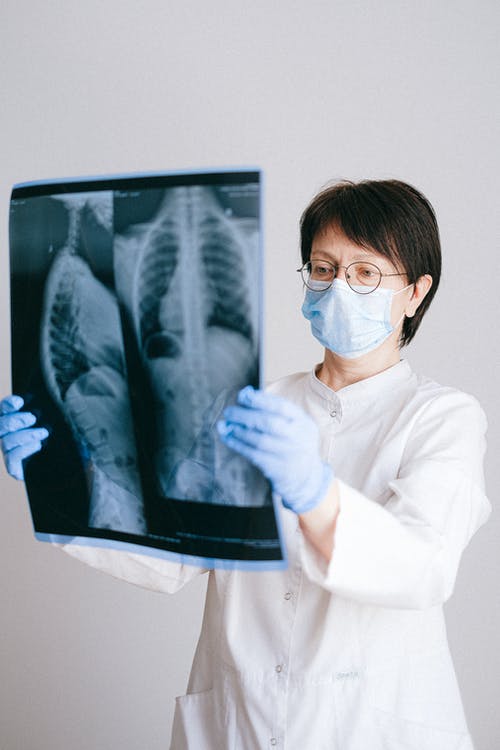

- Respiratory, organ, and heart issues, such as heart palpitations and difficulty breathing

- Neurological symptoms, from difficulty concentrating and sleep problems to depression and anxiety

- Digestive symptoms, changes in menstrual cycles and joint and muscle pain

- Fatigue

- Pulmonary, musculoskeletal, hematologic, renal, and endocrine issues

What You Can Do

Medical professionals can properly diagnose these symptoms, but connecting them to Long COVID also requires work on the patient’s part. By submitting contemporaneous medical records, all objective medical, occupational, and financial evidence, reports and receipts, and before and after declarations from friends, family, and coworkers to your LTD provider, you will more effectively demonstrate the severity of your Long COVID symptoms and how it prevents you from returning to your occupation or working in any capacity.

Supporting documents may also include functional capacity exams that help illustrate your intense, frequent, and debilitating symptoms and how they have impacted your ability to return to work. You may also consider a neuropsychological evaluation if you are experiencing cognitive symptoms.

Disability insurance plans typically provide coverage for a period expected to last 3 months or longer. Those who contracted COVID in 2020 and are still prevented from carrying out their occupational responsibilities, for example, may be considered long-haulers.

Timely and Comprehensively Appeal a Denied Group Claim

Disability insurance claims based on Long COVID are frequently denied. COVID-19 is still a relatively new disease. Consequently, so is Long Covid. The evidence threshold is still being established by carriers and treatments vary or are in development for these reasons alone. Furthermore, Long COVID is not specifically excluded in most current long- or short-term disability insurance policies, although some policies are now adding “post-viral syndrome” limitation in benefits.

Harkening back to the importance of medical records, you will need the avid support of your doctor’s office or medical group to help with disability paperwork, to write letters disputing the disability insurers’ doctor’s opinions and reports, and to communicate with LTD providers.

However, non-health-related concerns don’t necessarily have to come into the equation. If long COVID is affecting your financial stability, your disability insurance policy may have a role to play. If you feel you’ve been wrongfully delayed or denied your disability benefits and need to file an individual lawsuit or an administrative appeal under Employee Retirement Income Security Act (ERISA), it’s important to act quickly and comprehensively. Filing a timely, complete appeal of your group ERISA policy is crucial as whatever is not included in the appeal generally cannot be added later.

Contact a Long-Term Disability Lawyer

The expert knowledge in this long-term disability area continues to evolve, which means that COVID-19 disability insurance claims are rarely “black-and-white”.

Ongoing symptoms of the virus may still make you eligible for monthly disability insurance compensation. Depending on the wording of your policy, you may be able to qualify for disability benefits because all of your symptoms combined prevent you from doing your occupation, or any other occupation, reliably. In order to find out for sure, though, you’ll need to consult with an experienced long-term disability insurance lawyer.

For a free consultation with one of our disability insurance law specialists, contact Darras Law today.

Join the conversation!