Chopra has said he wants to bring the CFPB back to its original mission–holding corporations accountable for predatory or deceitful practices–while working towards bipartisan solutions.

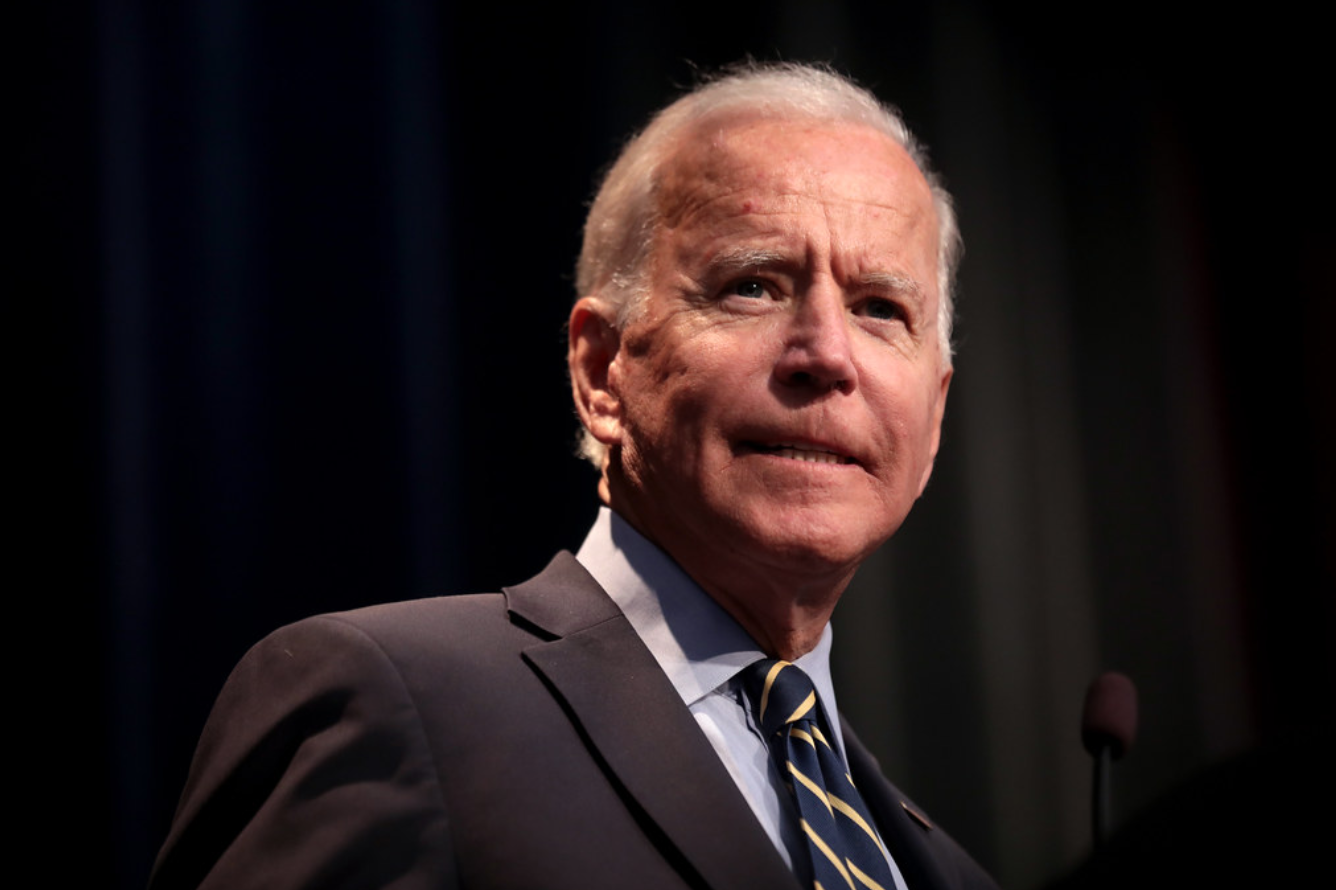

President Joe Biden has nominated Rohit Chopra to head the Consumer Financial Protection Bureau (CFPB), signaling the administration’s intent to revamp and reinvigorate the agency.

Chopra, says The Associated Press, currently serves as a Democratic commissioner on the Federal Trade Commission. If confirmed to the CFPB, he would be the third permanent director in the bureau’s decade-long history.

Under President Trump, the Consumer Financial Protection Bureau stopped aggressively pursuing predatory banks, lenders, and corporations. The former commander-in-chief appears to have acted deliberately in neutering the agency and decreasing its regulatory powers.

Republicans have, from the very onset, been critical of the CFPB’s aim, mission, and mechanisms.

However, Biden seems to be gearing up for some major reforms.

Shortly after taking office, for instance, Biden asked President Trump’s appointee to the CFPB—Kathy Kraninger—to step down.

Christine Hines, legislative director for the National Association of Consumer Advocates, told NBC News that the CFPB’s regulatory powers and purview declined under Trump and Kraninger.

“Consumer safeguards, enforcement, and general monitoring of the financial marketplace, arguably, were mediocre,” Hines stated. “The Bureau became more sympathetic to the regulated entities, to the detriment of consumers.”

Consumer Financial Protection Bureau via Wikimedia Commons, https://commons.wikimedia.org

Hines said she believes that the Biden administration is planning to rid the CFPB of its pro-corporate policies and stance.

Nevertheless, Chopra has pledged to work with Democrats and Republicans alike, in the hopes that the agency can find bipartisan backing.

Speaking to the Senate, Chopra said the Consumer Financial Protection Bureau must regain its strength—and hold companies accountable in ways only the federal government can.

“Economically it does not make sense that you rip someone off and don’t have to pay a penalty for it,” Chopra told the Senate. “Restitution is a critical part of the CFPB’s work.”

Chopra further said that “fair lending” will occupy a prominent and “critical” position for the agency as it move forwards and adapts to the Biden administration’s agenda.

While Chopra has tried to position himself as a possible bipartisan pick, he has advocated progressive stances on certain issues. He has, for instance, allied himself with Massachusetts Sen. Elizabeth Warren—a former Democratic presidential contender—and frequently garners praise from consumer advocacy groups that push back against big banks.

Joseph Lynak III, a partner at the law firm Dorsey & Whitney a regulatory reform expert, said the Biden administration is probably going walk back much of the guidance enacted by one of Kraninger’s other Trump-appointed predecessors, Mick Mulvaney.

“They will probably first of all look at the reorganization that Mr. Mulvaney put in place, and probably amend that or completely reverse that,” Lyank told NBC News. “There’s a whole host of things they will probably look at, ranging from the debt collection rule to payday lending.”

Sources

Biden consumer watchdog pick signals more aggressive stance

Biden’s CFPB nominee Rohit Chopra brings ‘substantive’ regulatory expertise

Join the conversation!