While your credit reports and scores are important, they are not a complete measure of your financial life. If you need to decide between providing for your family or protecting your credit score, family comes first.

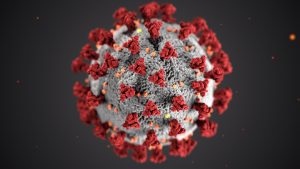

Temporary business closures and stay-at-home orders to slow the spread of coronavirus have had a significant impact on the U.S. economy. For the millions who are now unemployed, stress to make ends meet is rising.

While each day brings new headlines, there is some help for those impacted by the shutdown. The requirements to qualify for unemployment have temporarily been relaxed, and lenders are being more flexible with their borrowers. Still, consumers fear the long-term effects of this economic downturn, such as damaged credit scores and reliance on debt to pay for necessities.

Credit Scores and Unemployment

Consumers may be afraid of damage to their credit scores during the pandemic. Making a payment late, missing a payment entirely, racking up credit card debt, or applying for a handful of credit cards or loans at once can all hurt your credit scores. While these things can impact your score, there are a few myths that you shouldn’t believe.

Myth 1: Losing your income can tank your credit.

First, losing your income or your job won’t affect your credit scores. That’s because neither your income or your employment status are listed on your credit reports. Lenders still ask for your income to ensure you’ll be able to pay back what you owe, but your income will not impact your credit scores.

Myth 2: Filing for unemployment will impact your credit scores.

Second, filing for unemployment benefits won’t hurt your credit. This won’t appear on your credit reports. In fact, unemployment income is considered taxable by the IRS, so you can actually use your unemployment income as a source of income on credit applications.

Protecting Your Credit While Unemployed

There are steps you can take to protect your credit if you are unemployed or struggling financially due to the COVID-19 outbreak. Lenders are being more flexible than ever, with some offering to waive late payment fees, change payment due dates, or offer forbearance. The specific help being offered varies by lender, but calling your bank or credit card issuer is the best way to see what can be done to help your unique situation. If you don’t see your card issuer listed here, you can call the number on the back of your card.

In addition to requesting help from your lenders, you can also leverage your credit to your advantage if needed. If you have good credit, you might consider applying for a credit card offering a 0% APR introductory rate, which would allow you to pay down larger purchases without interest over a period of time. These introductory offers are usually good for about six months to a year, depending on the card, and you’ll have to pay the balance in full before the offer ends to avoid interest charges. In a situation where cash is tight, and a sudden expense like a broken refrigerator comes up, this could help ease the financial strain and allow you to keep more cash in your pocket to pay for your family’s necessities.

Proposed Legislation to Protect Your Credit During COVID-19

A bill introduced on March 17th aims to protect consumers from having damage dealt to their credit while we are in economic volatility due to COVID-19. S.3508 – Disaster Protection for Workers’ Credit Act of 2020 would amend the Fair Credit Reporting Act (FCRA) to place a four-month hold on all negative credit reporting, and would make it possible to extend that hold for longer if needed. It would also protect consumers from damage to their credit in future disasters. As of this writing, the bill is before the Senate Banking, Housing, and Urban Affairs Committee.

Currently, there is no legislation requiring lenders to withhold negative information from your credit reports. Credit bureaus are recommending that if you do miss a payment or have another negative mark on your credit reports due to loss of income during the pandemic, you can place a consumer statement on your credit report to explain your circumstances to future lenders.

While your credit reports and scores are important, they are not a complete measure of your financial life. If you need to decide between providing for your family or protecting your credit score, family comes first.

Join the conversation!