Effective management of risks contributes to a business’s capacity to meet debt servicing obligations, reducing the likelihood of financial setbacks and defaults.

Financial management significantly impacts the delicate balance of a company’s credits and debts, shaping a business’s creditworthiness and influencing its debt dynamics.

In this article, we’ll explain why financial management practices are closely connected to a business’s credits and debts. We’ll discuss various aspects, from smart budgeting to wise investment choices, to show how these strategies can strengthen or weaken a business’s standing in terms of credit and debt.

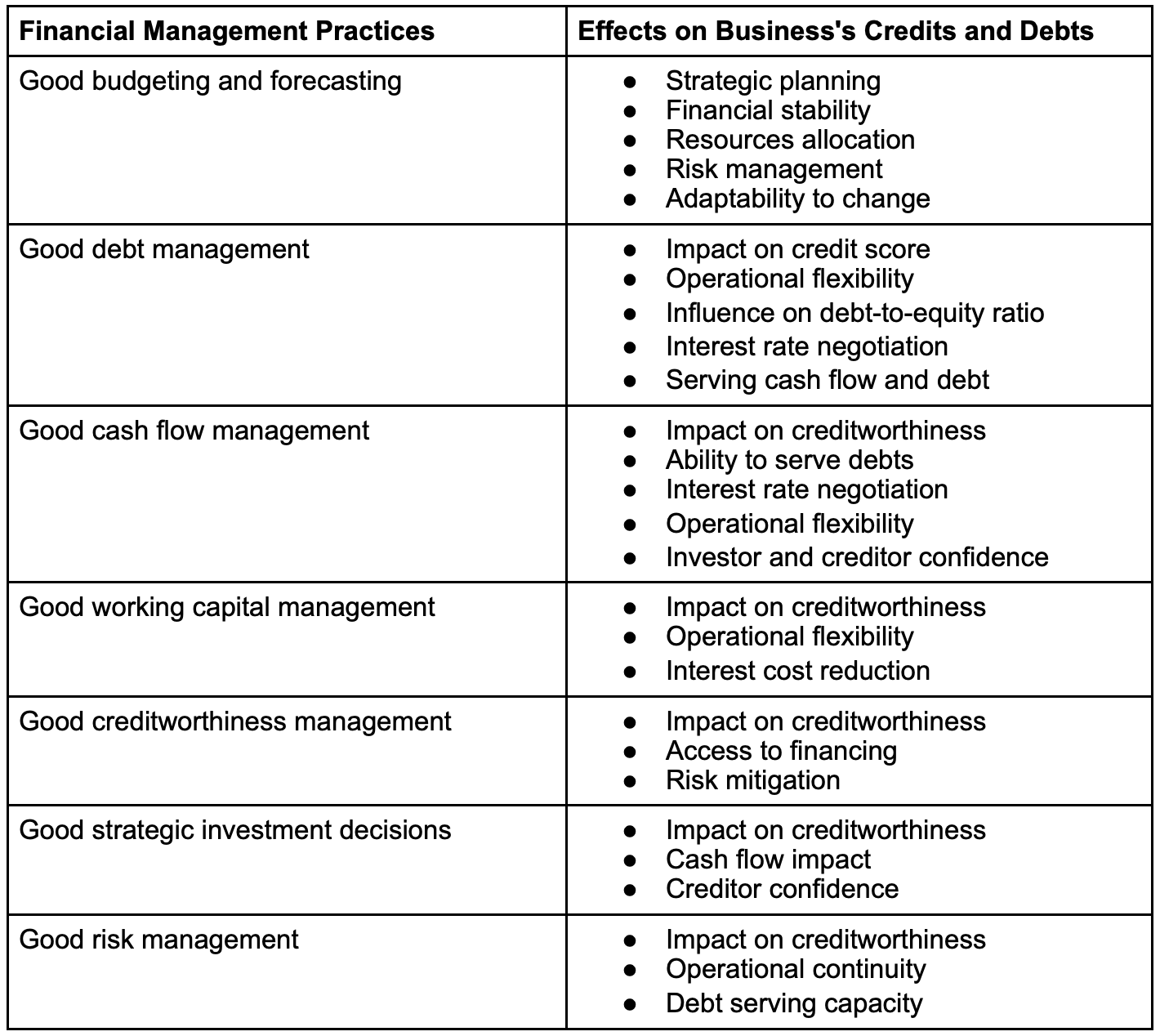

Financial Management Practices and Business’s Credits and Debts Connection Table

The table below is a visual representation of these key financial terms and how they are intertwined:

Budgeting and Forecasting

Budgeting and forecasting are foundational pillars of financial planning. They facilitate strategic planning by allowing businesses to allocate resources effectively and set realistic financial objectives. These practices contribute to financial stability by providing a roadmap for managing revenues, expenses, and investments in a structured manner.

Business budgeting represents a company’s anticipated earnings and outflows for a defined future timeframe. Businesses can allocate resources judiciously through budgeting, ensuring funds are directed to areas that align with organizational priorities.

Forecasting is a method that relies on past data to make informed estimates that are predictive in determining the direction of future trends. It enables businesses to anticipate potential financial risks, allowing for the implementation of proactive risk management strategies.

Budgets and forecasts serve as benchmarks for evaluating financial performance, enabling businesses to measure their success against predefined goals. A dynamic budgeting and forecasting process enables them to adapt to changing market conditions, ensuring resilience and agility in the face of uncertainties and global or local financial crises.

Debt Management

Debt management is the process of organizing and controlling debts to minimize financial risks and enhance the capacity to achieve financial objectives. It is crucial for maintaining a healthy financial profile and achieving long-term fiscal stability. Effective debt management impacts various facets of financial health:

- Prompt debt management directly affects a business’s credit score, influencing its credibility and ability to secure favorable credit terms.

- It offers businesses operational flexibility by allowing them to navigate uncertainties and pursue strategic initiatives without becoming excessively burdened by debt obligations.

- Debt management practices shape the debt-to-equity ratio, a critical metric influencing how creditors and investors perceive a business.

- Effective debt management may allow businesses to negotiate lower interest rates, reducing the financial burden of serving debts.

- It ensures that debt servicing aligns with the company’s cash flow, avoiding liquidity challenges and potential defaults.

Cash Flow Management

Cash flow management means controlling and monitoring the inflow and outflow of cash within a business. Effective cash flow management is essential for sustaining day-to-day operations, meeting financial obligations, and fostering long-term financial stability.

- It impacts a business’s creditworthiness, influencing its ability to secure favorable credit terms and maintain financial credibility.

- Effective cash flow management ensures a business can meet debt servicing obligations, reducing the risk of defaults and maintaining positive relationships with creditors.

- It enhances a business’s negotiating power for lower interest rates, ultimately reducing the financial burden of serving debts.

- Well-managed cash flow provides operational flexibility. It allows businesses to adapt to changing market conditions, invest in growth, and maintain financial resilience.

- It portrays a commitment to responsible financial practices and building positive financial relationships.

Business owners must apply proper AR management to improve cash flow, as timely invoicing, diligent follow-up on payments, and efficient credit terms contribute to a steady inflow of funds. They can ensure a healthier and more predictable cash flow by minimizing overdue receivables and optimizing the AR process.

Working Capital Management

Working capital management is a business process that helps companies use their current assets effectively to ensure effective operational liquidity and financial stability.

- Strategic working capital management influences a business’s creditworthiness, allowing it to secure favorable credit terms.

- It promotes operational efficiency, allowing businesses to maintain smoother cash flow cycles and reduce the reliance on external financing.

- Optimized working capital can contribute to reducing interest costs, as businesses can operate with lower debt levels and negotiate better terms with creditors.

Creditworthiness Management

Creditworthiness management involves maintaining and enhancing an individual’s or business’s ability to secure credit through responsible financial practices and a positive credit history.

Strategic creditworthiness management impacts a business’s eligibility for favorable credit terms, allowing it to access financial resources at more advantageous rates and enhancing its access to various financing forms, promoting liquidity and supporting growth initiatives.

Strong creditworthiness is a risk mitigation strategy, reducing the likelihood of financial instability and default.

Strategic Investment Decisions

Strategic investment decisions are carefully planned choices made by businesses. They allocate resources in a manner that aligns with long-term goals and maximizes returns. They can enhance a business’s creditworthiness by showcasing its ability to make smart financial decisions and generate returns.

Carefully planned investments positively impact a business’s cash flow, ensuring it has the liquidity needed to manage debts and grasp chances, portraying a business as financially prudent and capable of managing its credit and debt responsibilities.

Potential Challenges and Risks Management

Potential challenges and risk management are identifying, assessing, and strategically handling potential obstacles and uncertainties that may impact a business. Detecting potential challenges helps preserve a business’s creditworthiness by demonstrating foresight and risk management capabilities to creditors. And mitigating risks ensures operational continuity, minimizing disruptions that could adversely impact a business’s cash flow and ability to manage debt obligations.

Effective management of risks contributes to a business’s capacity to meet debt servicing obligations, reducing the likelihood of financial setbacks and defaults. All in all, effective financial management is crucial for the success of your business.

Join the conversation!