While we are all informed that companies and individuals are falling victim to identity theft in increasing numbers, did you know that child identity theft is also showing an increase? Why is this happening?

While we are all informed that companies and individuals are falling victim to identity theft in increasing numbers, did you know that child identity theft is also showing an increase? Why is this happening?

Credit histories of children are often blank slates; because of this, criminals may be able to get away with stealing a child’s identity for a long time because most people do not typically check their children’s credit reports. Without their use of credit cards, there may be no sign that anything is wrong until our children try to obtain credit, loans or jobs. While adults can freeze their lines of credit, we don’t usually think of doing this for our children. Children also tend to be more trusting; making them easier to take advantage of, sometimes by family friends and relatives.

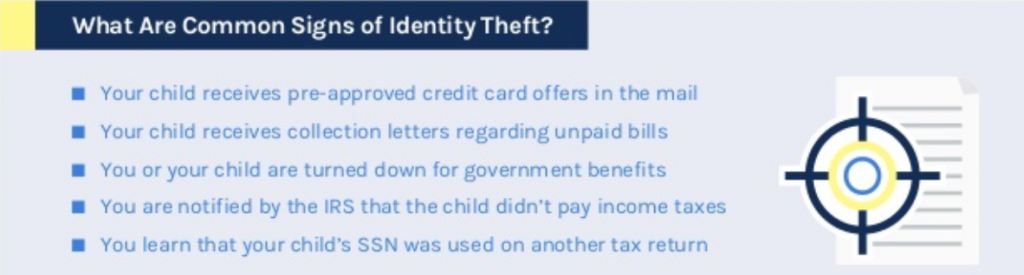

The accompanying infographic helps introduce more information on the subject. It displays the reasons why children and teens are at risk, the basic signs of child identity theft, and ways to help shield our teens and children from becoming victims of this crime. Click on the image below for more information courtesy of The Litvak Law Firm PLLC.

Join the conversation!