Make sure to keep every receipt, so all your additional expenses get reimbursed.

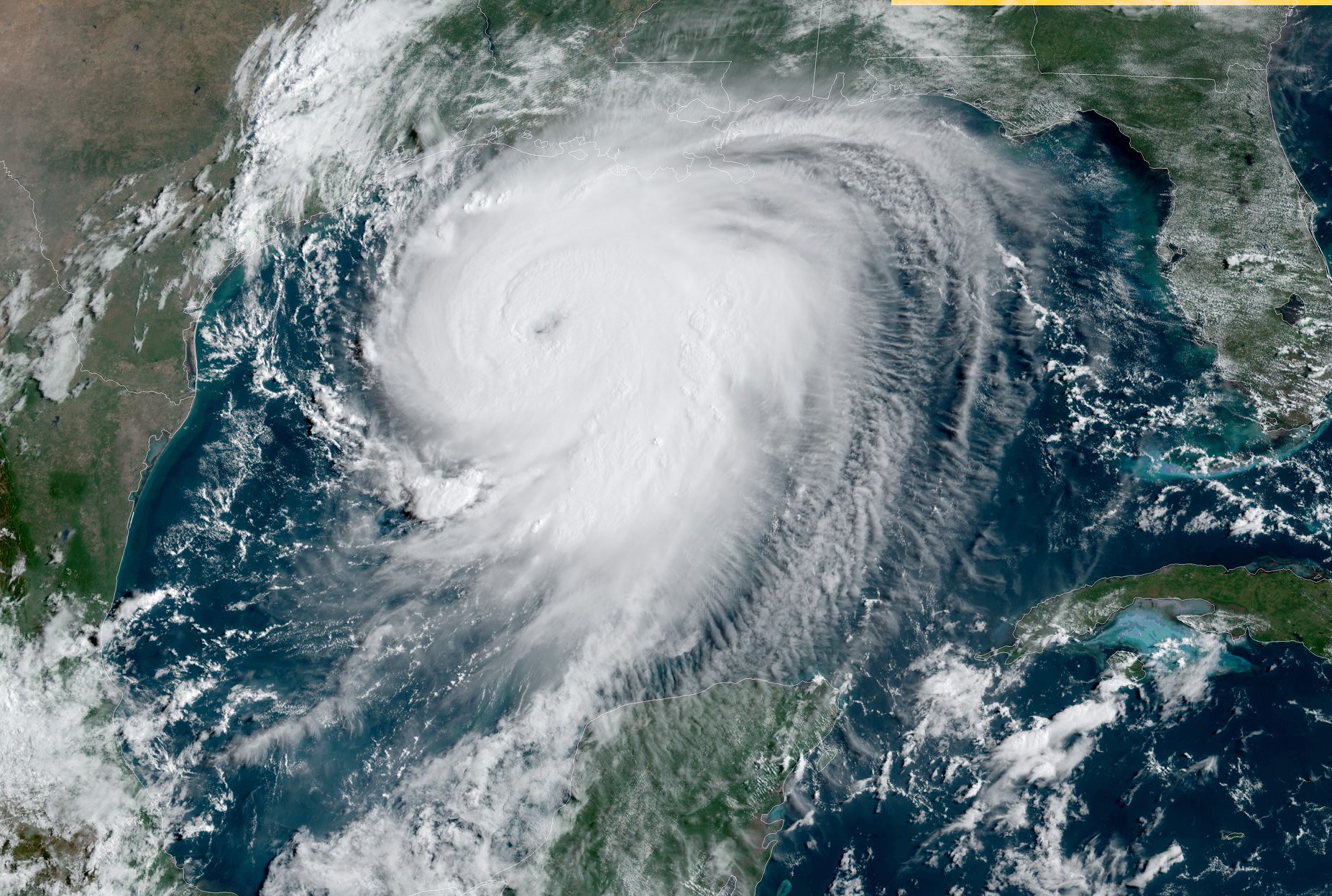

Metairie, LA – Hurricane Laura, that made landfall on August 21, 2020, in Cameron, LA, was one of the strongest ever to hit Louisiana in terms of maximum sustained winds. 30 people were killed in Louisiana alone during hurricane Laura and the property damages were enormous. According to the Red Cross, some 8,000 houses were destroyed in the US, with Louisiana and Texas bearing the brunt of the category 4 hurricane. The property damages are estimated at over $19 billion, making Laura one of the costliest storms ever to hit Louisiana.

While that might seem like a lot of money, what you need to know is that recovering damages after a storm is never easy. Just as you board up your windows ahead of a storm, you need to prepare for a possible insurance claim, by making sure you can easily retrieve the required documents and by knowing what are the best insurance claims lawyers in Louisiana. You might need one.

What is covered under homeowners insurance in Louisiana?

Standard homeowners insurance usually covers hurricane damage, including personal property that might get destroyed. Here are the perils covered by a typical homeowners insurance policy:

- Rain damage

- Hail damage

- Wind damage

- Uprooted or toppled trees

- Roof damage

- Exterior wall damage

- Foundation damage

- Garage or porch damage

- Loss of power or water supply

Recovering personal property damage might be a bit tricky as you will have to prove what exactly was destroyed during the hurricane. In preparation of a hurricane you should have a list of your valuables, stored somewhere safe. Keeping receipts of your most important possessions would also help.

If you don’t have such an inventory of goods, you should take photos of all the damage caused by the storm or hurricane.

You should also take steps to protect your valuables from further damage, which is not covered by insurance. This can be complicated as you cannot make any permanent repairs to the house before the insurance adjuster inspects the property and files a report. You can only make temporary repairs, like covering a roof leak with tarp.

Also, it is not recommended that you start cleaning up the house before the adjuster’s visit. They need to see the full extent of the damage. If you don’t agree with the adjuster’s report, a knowledgeable insurance claims lawyer can put you in touch with an independent adjuster.

What is covered under additional living expenses?

Additional living expenses kick in the moment your area is placed under a mandatory evacuation order. Also, if your property becomes uninhabitable after an insured event, the insurance company has to cover your living expenses, but make sure to read the fine print of your policy to make sure there are no exclusions. If the insurance company is objecting to your living expenses, talk to some skilled Louisiana insurance claims lawyers and they’ll sort things out.

You can be reimbursed for:

- Moving and transportation costs

- Hotel stay or rental cost

- Food and dining expenses

- Pet boarding

- Storage fees

- Washer and dryer costs

These expenses should be in keeping with your normal living standards. Moving to a 5-star hotel and having champagne with every meal won’t be considered normal living expenses.

Make sure to keep every receipt, so all your additional expenses get reimbursed. According to the law, the insurance company is required to settle a claim within 30 days of the initial notification, but don’t count on it.

If your house was recently damaged by a hurricane and the insurance company is delaying or refusing to pay your claim, talk to a seasoned hurricane lawyer at the Houghtaling Law Firm, LLC, in Metairie. Also, if the settlement offer doesn’t meet your expectations, the attorneys at Houghtaling Law Firm, LLC, can help you negotiate with the insurance company.

Join the conversation!