One of the first things your Indiana bankruptcy lawyers will advise you to do is gather all the necessary documents.

Indianapolis, IN – We rely on our court system to administer justice, yet even the best judges can occasionally make mistakes. Recently, an Indiana bankruptcy judge was accused by multinational conglomerate 3M Co. of making several errors during their case. These errors have now led the company to ask for a stay until the judge’s “errors” are reviewed.

This is why it’s important to hire the best lawyers when filing for bankruptcy so that they can ensure everything goes along smoothly. It’s also important that you educate yourself on bankruptcy basics in Indiana, to ensure a correct legal process.

Who qualifies for bankruptcy in Indiana?

Regardless if you’re a business entity or an individual down on their luck, the state of Indiana allows you to file for bankruptcy, as a means of regaining financial balance. If you have recently moved to Indiana from another state, you will want to make sure you meet the state’s eligibility criteria. According to the law, you must be an official Indiana residents at least 730 days before filing for bankruptcy in Indianapolis.

If this is not your first time filing for bankruptcy, things get a little muddier. Largely, whether or not you can file for bankruptcy again will depend on the type of bankruptcy you filed for previously, how much time has passed, and what type of bankruptcy you’re attempting to file for now.

Your best bet would be to consult our Indianapolis bankruptcy lawyers, to check that you qualify for filing again.

What are the different types of bankruptcy?

In Indiana, as in most other states, an individual filing for bankruptcy will typically have to choose between Chapter 7 and Chapter 13 bankruptcy. Through Chapter 7 bankruptcy, the court trustees will sell your property, until your debts are paid. Through Chapter 13, the courts will come up with a monthly payment plan that allows you to keep your property, while also paying off debt.

Although to be fair, the choice isn’t really up to you. If you can not prove a stable income, then the courts are unlikely to trust that you’ll honor a monthly payment plan. In other words, Chapter 7 may be the only option for you if you do not benefit from stable employment, or fall under the median state income for your family.

What documents do I need?

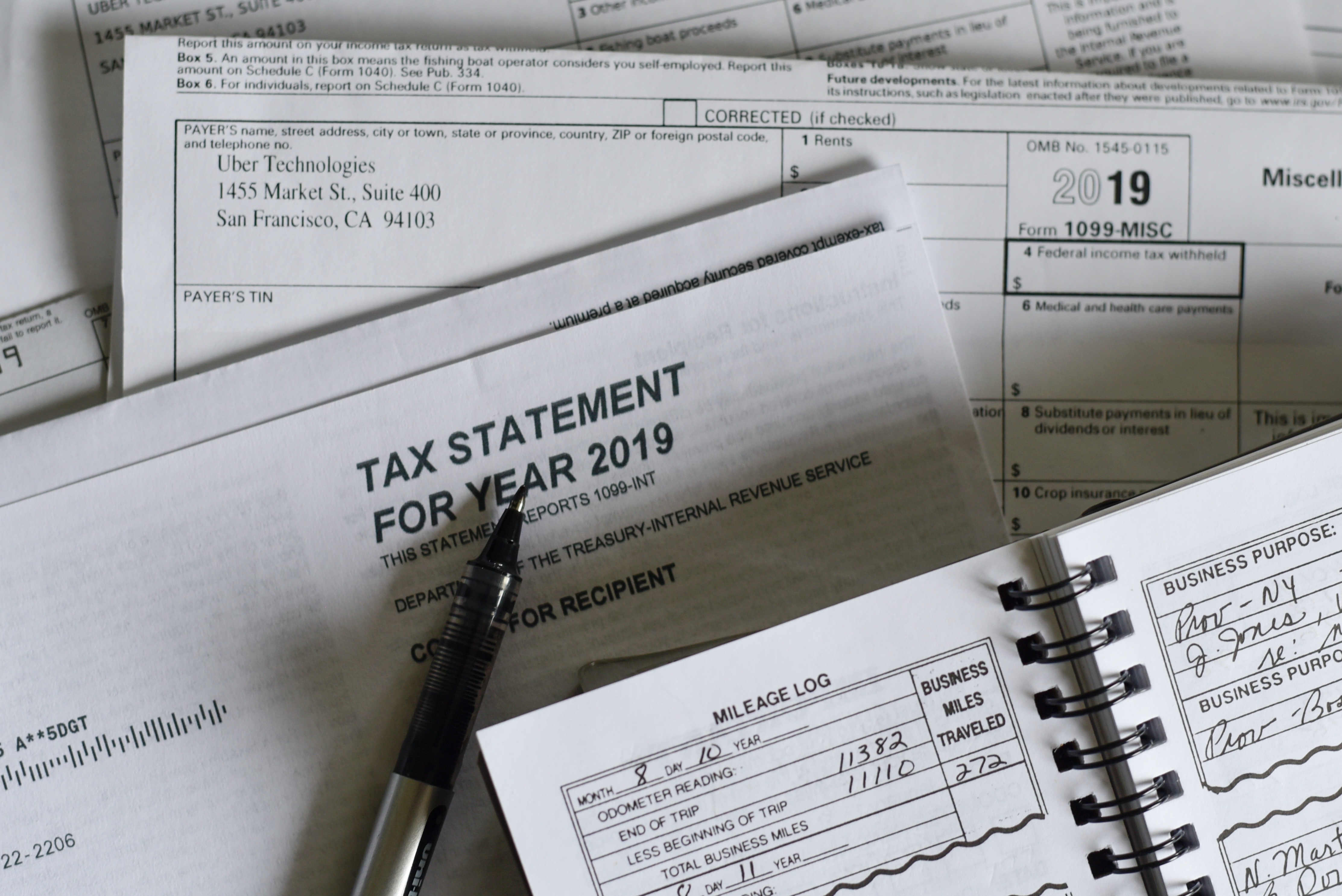

One of the first things your Indiana bankruptcy lawyers will advise you to do is gather all the necessary documents. Typically, you will need:

- Tax returns (previous 2 years for Chapter 7, or previous 4 years for Chapter 13);

- Proof of income (both from employer, and other incomes; at least 6 months);

- Bank statements (2-6 months);

- Retirement and pension statements (2-6 months);

- Driver’s License, Social Security Card (copies);

- Profit and loss statements (if you own a business);

- Credit card and billing statements.

The courts may also ask you to provide valuations for your home, vehicle, and any antique or unusual items in your possession, as well as a list of any valuables you own. Of course, what the court asks for will vary from case to case – ask your Indianapolis bankruptcy lawyers for a comprehensive list of what documents you’ll need to file!

Source: Citing bankruptcy judge’s ‘errors,’ 3M begs appeals court for stay in earplugs MDL

Join the conversation!